MOOC | Perry Mehrling - Economics of Money and Banking

ColumbiaLearn

321 部影片

觀看次數:6,137

上次更新日期:2015年12月15日

Discover how modern money actually works, where the current system came from, and where it seems to be going. The course, filmed live at Barnard College, is organized in two parts. “Introduction” explores the economics of payments systems and money markets. “Advanced” explores connections with foreign exchange and capital markets.

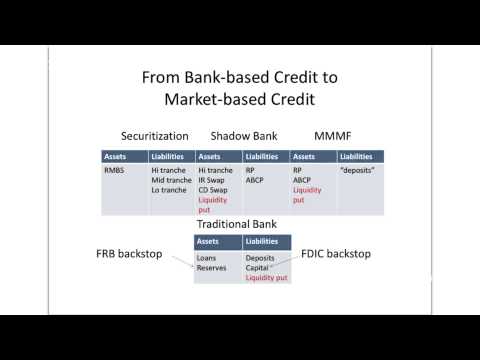

The last three or four decades have seen a remarkable evolution in the institutions that comprise the modern monetary system. The financial crisis of 2007-2009 was a wakeup call that we need a similar evolution in the analytical apparatus and theories that we use to understand that system.

Three features of the new system are central.

Most important, the intertwining of previously separate capital markets and money markets has produced a system with new dynamics as well as new vulnerabilities. The financial crisis revealed those vulnerabilities for all to see. The result was two years of desperate innovation by central banking authorities as they tried first this, and then that, in an effort to stem the collapse.

Second, the global character of the crisis has revealed the global character of the system, which is something new in postwar history but not at all new from a longer time perspective. Central bank cooperation was key to stemming the collapse, and the details of that cooperation hint at the outlines of an emerging new international monetary order.

Third, absolutely central to the crisis was the operation of key derivative contracts, most importantly credit default swaps and foreign exchange swaps. Modern money cannot be understood separately from modern finance, nor can modern monetary theory be constructed separately from modern financial theory. That's the reason this course places dealers, in both capital markets and money markets, at the very center of the picture, as profit-seeking suppliers of market liquidity to the new system of market-based credit.

Enroll today:

https://www.coursera.org/instructor/~811

Visit Perry Mehrling’s website:

http://perrymehrling.com 較少資訊

全部播放 分享 已儲存

MOOC | Lec 1: The Four Prices of Money | Part 1: The Big Picture

上傳者:ColumbiaLearn

19:26

MOOC | Lec 1: The Four Prices of Money | Part 2: Prerequisites?

上傳者:ColumbiaLearn

7:22

MOOC | Lec 1: The Four Prices of Money | Part 3: What is a Bank, a Shadow Bank, a Central Bank

上傳者:ColumbiaLearn

12:10

MOOC | Lec 1: The Four Prices of Money | Part 4: Central Themes

上傳者:ColumbiaLearn

13:09

MOOC | Lec 1: The Four Prices of Money | Part 5: Readings: Allyn Young

上傳者:ColumbiaLearn

3:10

MOOC | Lec 2: The Natural Hierarchy of Money | Part 1: The Eurocrisis, Liquidity vs. Solvency

上傳者:ColumbiaLearn

10:05

MOOC | Lec 2: The Natural Hierarchy of Money | Part 2: Hierarchy of Financial Instruments

上傳者:ColumbiaLearn

9:39

MOOC | Lec 2: The Natural Hierarchy of Money | Part 3: Hierarchy of Financial Institutions

上傳者:ColumbiaLearn

6:37

MOOC | Lec 2: The Natural Hierarchy of Money | Part 4: Dynamics of the Hierarchy

上傳者:ColumbiaLearn

6:08

MOOC | Lec 2: The Natural Hierarchy of Money | Part 5: Discipline and Elasticity

上傳者:ColumbiaLearn

8:49

MOOC | Lec 2: The Natural Hierarchy of Money | Part 6: Hierarchy of Market Makers

上傳者:ColumbiaLearn

9:17

MOOC | Lec 2: The Natural Hierarchy of Money | Part 7: Managing the Hierarchy

上傳者:ColumbiaLearn

18:03

MOOC | Lec 3: Money and the State: Domestic | Part 1: Quantitative Easing and the Fed

上傳者:ColumbiaLearn

7:47

MOOC | Lec 3: Money and the State: Domestic | Part 2: Allyn Young: Money and Economic Orthodoxy

上傳者:ColumbiaLearn

9:09

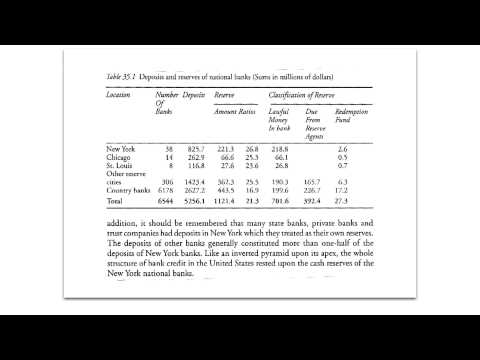

MOOC | Lec 3: Money and the State: Domestic | Part 3: National Banking System before the Fed

上傳者:ColumbiaLearn

3:22

MOOC | Lec 3: Money and the State: Domestic | Part 4: Civil War Finance, bonds and loans

上傳者:ColumbiaLearn

8:49

MOOC | Lec 3: Money and the State: Domestic | Part 5: Civil War Finance, legal tenders

上傳者:ColumbiaLearn

7:07

MOOC | Lec 3: Money and the State: Domestic | Part 6: National Banking System, origins

上傳者:ColumbiaLearn

6:30

MOOC | Lec 3: Money and the State: Domestic | Part 7: National Banking System, instability

上傳者:ColumbiaLearn

5:57

MOOC | Lec 3: Money and the State: Domestic | Part 8: Federal Reserve System, plan

上傳者:ColumbiaLearn

6:32

MOOC | Lec 3: Money and the State: Domestic | Part 9: Federal Reserve System, actual

上傳者:ColumbiaLearn

6:48

MOOC | Lec 4: The Money View, Micro and Macro | Part 1: FT: Dealer of Last Resort

上傳者:ColumbiaLearn

5:23

MOOC | Lec 4: The Money View, Micro and Macro | Part 2: Reading: Hyman Minsky

上傳者:ColumbiaLearn

3:07

MOOC | Lec 4: The Money View, Micro and Macro | Part 3: Payments: Money and Credit

上傳者:ColumbiaLearn

5:36

MOOC | Lec 4: The Money View, Micro and Macro | Part 4: Payments: Discipline and Elasticity

上傳者:ColumbiaLearn

4:13

MOOC | Lec 4: The Money View, Micro and Macro | Part 5: The Survival Constraint

上傳者:ColumbiaLearn

3:35

MOOC | Lec 4: The Money View, Micro and Macro | Part 6: Sources and Uses Accounts

上傳者:ColumbiaLearn

6:55

MOOC | Lec 4: The Money View, Micro and Macro | Part 7: Payment Example: Money and Credit

上傳者:ColumbiaLearn

10:05

MOOC | Lec 4: The Money View, Micro and Macro | Part 8: Flow of Funds Accounts

上傳者:ColumbiaLearn

10:10

MOOC | Lec 4: The Money View, Micro and Macro | Part 9: The Survival Constraint, redux

上傳者:ColumbiaLearn

2:40

MOOC | Lec 4: The Money View, Micro and Macro | Part 10: Liquidity, Long and Short

上傳者:ColumbiaLearn

9:42

MOOC | Lec 4: The Money View, Micro and Macro | Part 11: Financial Fragility, Flows and Stocks

上傳者:ColumbiaLearn

6:23

MOOC | Lec 5: The Central Bank as a Clearinghouse | Part 1: Martin Wolf on QE3

上傳者:ColumbiaLearn

3:16

MOOC | Lec 5: The Central Bank as a Clearinghouse | Part 2: One Big Bank

上傳者:ColumbiaLearn

8:20

MOOC | Lec 5: The Central Bank as a Clearinghouse | Part 3: Multiple Banks, a challenge

上傳者:ColumbiaLearn

3:56

MOOC | Lec 5: The Central Bank as a Clearinghouse | Part 4: Reading: Charles F. Dunbar

上傳者:ColumbiaLearn

2:05

MOOC | Lec 5: The Central Bank as a Clearinghouse | Part 5: Correspondent banking

上傳者:ColumbiaLearn

10:24

MOOC | Lec 5: The Central Bank as a Clearinghouse | Part 6: Correspondent banking, system network

上傳者:ColumbiaLearn

3:55

MOOC | Lec 5: The Central Bank as a Clearinghouse | Part 7: Clearinghouse, normal operations

上傳者:ColumbiaLearn

8:28

MOOC | Lec 5: The CB as a Clearinghouse | Part 8: Clearinghouse, private lender of last resort

上傳者:ColumbiaLearn

10:44

MOOC | Lec 5: The Central Bank as a Clearinghouse | Part 9: Central Bank Clearing

上傳者:ColumbiaLearn

4:54

MOOC | Lec 5: The Central Bank as a Clearinghouse | Part 10: Central Bank Cooperation

上傳者:ColumbiaLearn

5:41

MOOC | Lec 6: Federal Funds, Final Settlement | Part 1: European Bank Deleveraging

上傳者:ColumbiaLearn

5:43

MOOC | Lec 6: Federal Funds, Final Settlement | Part 2: What are Fed Funds?

上傳者:ColumbiaLearn

5:13

MOOC | Lec 6: Federal Funds, Final Settlement | Part 3: Payment settlement versus Required Reserves

上傳者:ColumbiaLearn

1:11

MOOC | Lec 6: Federal Funds, Final Settlement | Part 4: Payment elasticity/discipline

上傳者:ColumbiaLearn

9:03

MOOC | Lec 6: Federal Funds, Final Settlement | Part 5: The Function of the Fed Funds Market

上傳者:ColumbiaLearn

9:15

MOOC | Lec 6: Federal Funds, Final Settlement | Part 6: Payment versus Funding: an example

上傳者:ColumbiaLearn

11:24

MOOC | Lec 6: Federal Funds, Final Settlement | Part 7: Brokers versus Dealers

上傳者:ColumbiaLearn

2:03

MOOC | Lec 6: Federal Funds, Final Settlement | Part 8: Payments Imbalances and the Fed Funds Rate

上傳者:ColumbiaLearn

7:06

MOOC | Lec 6: Federal Funds, Final Settlement | Part 9: Secured versus Unsecured Interbank Credit

上傳者:ColumbiaLearn

5:05

MOOC | Lec 6: Federal Funds, Final Settlement | Part 10: Required Reserves, redux

上傳者:ColumbiaLearn

7:20

MOOC | Lec 7: Repos, Postponing Settlement | Part 1: The impact of QE3

上傳者:ColumbiaLearn

2:45

MOOC | Lec 7: Repos, Postponing Settlement | Part 2: Money Market Interest Rate Patterns

上傳者:ColumbiaLearn

3:34

MOOC | Lec 7: Repos, Postponing Settlement | Part 3: What is repo?

上傳者:ColumbiaLearn

3:19

MOOC | Lec 7: Repos, Postponing Settlement | Part 4: Repo in balance sheets

上傳者:ColumbiaLearn

7:34

MOOC | Lec 7: Repos, Postponing Settlement | Part 5: Comparison with Fed Funds

上傳者:ColumbiaLearn

5:09

MOOC | Lec 7: Repos, Postponing Settlement | Part 6: Legal construction of repo

上傳者:ColumbiaLearn

9:46

MOOC | Lec 7: Repos, Postponing Settlement | Part 7: Security dealers balance sheet

上傳者:ColumbiaLearn

11:07

MOOC | Lec 7: Repos, Postponing Settlement | Part 8: Repo, modern finance, and the Fed

上傳者:ColumbiaLearn

8:49

MOOC | Lec 7: Repos, Postponing Settlement | Part 9: Interest rate spreads: before the crisis

上傳者:ColumbiaLearn

5:33

MOOC | Lec 7: Repos, Postponing Settlement | Part 10: Interest rate spreads: after the crisis

上傳者:ColumbiaLearn

8:07

MOOC | Lec 8: Eurodollars, Parallel Settlement | Part 1: FT: Ring-fencing and the Volcker Rule

上傳者:ColumbiaLearn

9:45

MOOC | Lec 8: Eurodollars, Parallel Settlement | Part 2: The Eurodollar Market in Crisis

上傳者:ColumbiaLearn

4:51

MOOC | Lec 8: Eurodollars, Parallel Settlement | Part 3: What are Eurodollars?

上傳者:ColumbiaLearn

7:11

MOOC | Lec 8: Eurodollars, Parallel Settlement | Part 4: Why is there a Eurodollar market?

上傳者:ColumbiaLearn

4:43

MOOC | Lec 8: Eurodollars, Parallel Settlement | Part 5: Eurodollar as global funding market

上傳者:ColumbiaLearn

11:33

MOOC | Lec 8: Eurodollars, Parallel Settlement | Part 6: Liquidity challenge of Eurodollar banks

上傳者:ColumbiaLearn

10:59

MOOC | Lec 8: Eurodollars, Parallel Settlement | Part 7: FRA as implicit swap of IOUs

上傳者:ColumbiaLearn

4:34

MOOC | Lec 8: Eurodollars, Parallel Settlement | Part 8: Forward Parity, Interest Rates, EH

上傳者:ColumbiaLearn

8:58

MOOC | Lec 8: Eurodollars, Parallel Settlement | Part 9: Forward Parity, Exchange Rates, UIP

上傳者:ColumbiaLearn

2:48

MOOC | Lec 8: Central Banking for Shadow Banking | Part 10: Forward rates aren't expected spot rates

上傳者:ColumbiaLearn

2:49

MOOC | Lec 9: The World that Bagehot Knew | Part 1: FT: Depreciation of Iran's currency

上傳者:ColumbiaLearn

3:37

MOOC | Lec 9: The World that Bagehot Knew | Part 2: Reading: John Hicks

上傳者:ColumbiaLearn

3:38

MOOC | Lec 9: The World that Bagehot Knew | Part 3: Bagehot's World, wholesale money market

上傳者:ColumbiaLearn

7:57

MOOC | Lec 9: The World that Bagehot Knew | Part 4: Economizing on notes: deposits, acceptances

上傳者:ColumbiaLearn

8:28

MOOC | Lec 9: The World that Bagehot Knew | Part 5: Managing cash flow: discount, rediscount

上傳者:ColumbiaLearn

7:29

MOOC | Lec 9: The World that Bagehot Knew | Part 6: Market rate of interest

上傳者:ColumbiaLearn

2:44

MOOC | Lec 9: The World that Bagehot Knew | Part 7: Central Bank and bank rate

上傳者:ColumbiaLearn

8:13

MOOC | Lec 9: The World that Bagehot Knew | Part 8: The Bagehot Rule, origin of monetary policy

上傳者:ColumbiaLearn

4:38

MOOC | Lec 9: The World that Bagehot Knew | Part 9: Limits on central banking

上傳者:ColumbiaLearn

10:20

MOOC | Lec 10: Dealers and Liquid Security Markets | Part 1: FT: Asymmetric Credit Growth in Europe

上傳者:ColumbiaLearn

6:33

MOOC | Lec 10: Dealers and Liquid Security Markets | Part 2: Liquidity, dealers, and inventories

上傳者:ColumbiaLearn

7:10

MOOC | Lec 10: Dealers and Liquid Security Markets | Part 3: Two-sided dealer basics

上傳者:ColumbiaLearn

6:31

MOOC | Lec 10: Dealers and Liquid Security Markets | Part 4: Economics of the dealer function

上傳者:ColumbiaLearn

11:43

MOOC | Lec 10: Dealers and Liquid Security Markets | Part 5: Leveraged dealer basics

上傳者:ColumbiaLearn

7:22

MOOC | Lec 10: Dealers and Liquid Security Markets | Part 6: Real world dealers

上傳者:ColumbiaLearn

7:56

MOOC | Lec 10: Dealers and Liquid Security Markets | Part 7: The assumption of perfect liquidity

上傳者:ColumbiaLearn

9:41

MOOC | Lec 11: Banks and the Market for Liquidity | Part 1: FT: Money Market Mutual Funds

上傳者:ColumbiaLearn

6:46

MOOC | Lec 11: Banks and the Market for Liquidity | Part 2: Banks as money dealers, a puzzle

上傳者:ColumbiaLearn

4:15

MOOC | Lec 11: Banks and the Market for Liquidity | Part 3: Security dealers as money dealers

上傳者:ColumbiaLearn

11:19

MOOC | Lec 11: Banks and the Market for Liquidity | Part 4: Adapting Treynor to liquidity risk

上傳者:ColumbiaLearn

6:33

MOOC | Lec 11: Banks and the Market for Liquidity | Part 5: Evolution of American banking

上傳者:ColumbiaLearn

11:30

MOOC | Lec 11: Banks and the Market for Liquidity | Part 6: The Fed in the Fed Funds market

上傳者:ColumbiaLearn

12:48

MOOC | Lec 11: Banks and the Market for Liquidity | Part 7: Return to the initial puzzle

上傳者:ColumbiaLearn

2:14

MOOC | Lec 12: Lender/Dealer of Last Resort | Part 1: FT: Citibank and the SIVs

上傳者:ColumbiaLearn

5:10

MOOC | Lec 12: Lender/Dealer of Last Resort | Part 2: The Art of Central Banking

上傳者:ColumbiaLearn

3:42

MOOC | Lec 12: Lender/Dealer of Last Resort | Part 3: Evolution of Monetary Policy: 1951-1987

上傳者:ColumbiaLearn

7:06

MOOC | Lec 12: Lender/Dealer of Last Resort | Part 4: The Taylor Rule: 1987-2007

上傳者:ColumbiaLearn

7:04

MOOC | Lec 12: Lender/Dealer of Last Resort | Part 5: Monetary Transmission Mechanism

上傳者:ColumbiaLearn

10:00

MOOC | Lec 12: Lender/Dealer of Last Resort | Part 6: Anatomy of a normal crisis

上傳者:ColumbiaLearn

8:18

MOOC | Lec 12: Lender/Dealer of Last Resort | Part 7: Anatomy of a serious crisis

上傳者:ColumbiaLearn

4:32

MOOC | Lec 12: Lender/Dealer of Last Resort | Part 8: Should the Fed intervene or not?

上傳者:ColumbiaLearn

8:40

MOOC | Lec 12: Lender/Dealer of Last Resort | Part 9: The Fed as Dealer of Last Resort: 2007-2009

上傳者:ColumbiaLearn

15:50

MOOC | Lec 13: Chartallism, Metallism, and Key Currencies | Part 1: FT: Autonomy of Bank of Japan

上傳者:ColumbiaLearn

2:14

MOOC | Lec 13: Chartallism, Metallism, and Key Currencies | Part 2: Key Currencies

上傳者:ColumbiaLearn

8:38

MOOC | Lec 13: Chartallism, Metallism | Part 3: What is Money? Chartalism versus Metallism

上傳者:ColumbiaLearn

8:37

MOOC | Lec 13: Chartallism, Metallism | Part 4: What is Money? Chartalism as a theory of money

上傳者:ColumbiaLearn

2:11

MOOC | Lec 13: Chartallism, Metallism | Part 5: What is Money? Quantity Theory of Money

上傳者:ColumbiaLearn

4:39

MOOC | Lec 13: Chartallism, Metallism | Part 6: Purchasing Power Parity

上傳者:ColumbiaLearn

3:02

MOOC | Lec 13: Chartallism, Metallism | Part 7: Metallism as a theory of money

上傳者:ColumbiaLearn

5:07

MOOC | Lec 13: Chartallism, Metallism | Part 8: A Money View of International Payments, FX Dealers

上傳者:ColumbiaLearn

11:36

MOOC | Lec 13: Chartallism, Metallism | Part 9: Chartallism, Metallism, and the Money View compared

上傳者:ColumbiaLearn

4:29

MOOC | Lec 13: Chartallism, Metallism | Part 10: Private and Public Money: A Hybrid System

上傳者:ColumbiaLearn

7:30

MOOC | Lec 13: Chartallism, Metallism | Part 11: Hybridity in FX Market-making

上傳者:ColumbiaLearn

5:33

MOOC | Lec 14: Money and the State: International | Part 1: FT: Costs of Japan's Monetary Policy

上傳者:ColumbiaLearn

2:49

MOOC | Lec 14: Money and the State: International | Part 2: Reading: Robert Mundell

上傳者:ColumbiaLearn

10:27

MOOC | Lec 14: Money and the State: International | Part 3: Confrontation

上傳者:ColumbiaLearn

11:48

MOOC | Lec 14: Money and the State: International | Part 4: Contradiction

上傳者:ColumbiaLearn

14:08

MOOC | Lec 14: Money and the State: International | Part 5: The Dollar System

上傳者:ColumbiaLearn

7:04

MOOC | Lec 14: Money and the State: International | Part 6: Flexible exchange

上傳者:ColumbiaLearn

8:28

MOOC | Lec 14: Money and the State: International | Part 7: Global Financial Crisis

上傳者:ColumbiaLearn

17:58

MOOC | Lec 15: Banks and Global Liquidity | Part 1: FT: European money market funds

上傳者:ColumbiaLearn

2:37

MOOC | Lec 15: Banks and Global Liquidity | Part 2: International transactions

上傳者:ColumbiaLearn

11:42

MOOC | Lec 15: Banks and Global Liquidity | Part 3: Dealer model for foreign exchange

上傳者:ColumbiaLearn

10:05

MOOC | Lec 15: Banks and Global Liquidity | Part 4: Central banking, defense of domestic exchange

上傳者:ColumbiaLearn

8:43

MOOC | Lec 15: Banks and Global Liquidity | Part 5: Bank of England, defense against external drain

上傳者:ColumbiaLearn

12:08

MOOC | Lec 15: Banks and Global Liquidity | Part 6: Toward a theory of exchange

上傳者:ColumbiaLearn

9:37

MOOC | Lec 16: Foreign Exchange | Part 1: FT: High frequency trading

上傳者:ColumbiaLearn

4:41

MOOC | Lec 16: Foreign Exchange | Part 2: Uncovered interest parity

上傳者:ColumbiaLearn

2:22

MOOC | Lec 16: Foreign Exchange | Part 3: FX dealers under the gold standard, redux

上傳者:ColumbiaLearn

5:03

MOOC | Lec 16: Foreign Exchange | Part 4: Private FX dealing system

上傳者:ColumbiaLearn

10:41

MOOC | Lec 16: Foreign Exchange | Part 5: Economics of the dealer function, speculative dealer

上傳者:ColumbiaLearn

5:58

MOOC | Lec 16: Foreign Exchange | Part 6: Economics of the dealer function, matched-book dealer

上傳者:ColumbiaLearn

6:15

MOOC | Lec 16: Foreign Exchange | Part 7: Digression: Why do UIP and EH fail?

上傳者:ColumbiaLearn

9:45

MOOC | Lec 16: Foreign Exchange | Part 8: Central bank as FX dealer of last resort

上傳者:ColumbiaLearn

16:09

MOOC | Lec 16: Foreign Exchange | Part 9: Reading: McCauley on internationalization of renminbi

上傳者:ColumbiaLearn

10:29

MOOC | Lec 17: Direct and Indirect Finance | Part 1: FT: Shadow banking

上傳者:ColumbiaLearn

4:15

MOOC | Lec 17: Direct and Indirect Finance | Part 2: Bagehot's World

上傳者:ColumbiaLearn

8:51

MOOC | Lec 17: Direct and Indirect Finance | Part 3: The New World

上傳者:ColumbiaLearn

10:55

MOOC | Lec 17: Direct and Indirect Finance | Part 4: Funding liquidity versus market liquidity

上傳者:ColumbiaLearn

2:33

MOOC | Lec 17: Direct and Indirect Finance | Part 5: Digression: Schumpeter on banking

上傳者:ColumbiaLearn

4:05

MOOC | Lec 17: Direct and Indirect Finance | Part 6: Payment versus funding

上傳者:ColumbiaLearn

5:31

MOOC | Lec 17: Direct and Indirect Finance | Part 7: Reading: Gurley and Shaw

上傳者:ColumbiaLearn

2:04

MOOC | Lec 17: Direct and Indirect Finance | Part 8: Financial evolution

上傳者:ColumbiaLearn

13:12

MOOC | Lec 17: Direct and Indirect Finance | Part 9: Banking evolution

上傳者:ColumbiaLearn

11:12

MOOC | Lec 17: Direct and Indirect Finance | Part 10: Preview: Central banking and shadow banking

上傳者:ColumbiaLearn

8:28

MOOC | Lec 18: Forwards and Futures | Part 1: Preview: FT: Argentina in court to fight debt ruling

上傳者:ColumbiaLearn

4:56

MOOC | Lec 18: Forwards and Futures | Part 2: Banking as advance clearing

上傳者:ColumbiaLearn

5:55

MOOC | Lec 18: Forwards and Futures | Part 3: Forwards versus futures

上傳者:ColumbiaLearn

13:41

MOOC | Lec 18: Forwards and Futures | Part 4: Futures contracts, fluctuations II

上傳者:ColumbiaLearn

14:07

MOOC | Lec 18: Forwards and Futures | Part 5: Futures contracts, fluctuations II

上傳者:ColumbiaLearn

6:07

MOOC | Lec 18: Forwards and Futures | Part 6: Cash and carry arbitrage, defined

上傳者:ColumbiaLearn

7:28

MOOC | Lec 18: Forwards and Futures | Part 7: Cash and carry arbitrage, explained as liquidity risk

上傳者:ColumbiaLearn

5:26

MOOC | Lec 18: Forwards and Futures | Part 8: Cash and carry arbitrage as counterparty risk

上傳者:ColumbiaLearn

2:49

MOOC | Lec 18: Forwards and Futures | Part 9: Cash and carry arbitrage, as natural banking business

上傳者:ColumbiaLearn

3:22

MOOC | Lec 19: Interest Rate Swaps | Part 1: FT: Sovereign debt crises

上傳者:ColumbiaLearn

3:21

MOOC | Lec 19: Interest Rate Swaps | Part 2: Reading: FOMC Report (1952)

上傳者:ColumbiaLearn

7:40

MOOC | Lec 19: Interest Rate Swaps | Part 3: Treasury-swap spread, a puzzle

上傳者:ColumbiaLearn

11:04

MOOC | Lec 19: Interest Rate Swaps | Part 4: What is a swap

上傳者:ColumbiaLearn

10:35

MOOC | Lec 19: Interest Rate Swaps | Part 5: Why swap? An example from Stigum

上傳者:ColumbiaLearn

10:37

MOOC | Lec 19: Interest Rate Swaps | Part 6: Market making in swaps

上傳者:ColumbiaLearn

8:42

MOOC | Lec 19: Interest Rate Swaps | Part 7: Money market swaps, example

上傳者:ColumbiaLearn

5:57

MOOC | Lec 19: Interest Rate Swaps | Part 8: Life in Arbitrage Land

上傳者:ColumbiaLearn

5:04

MOOC | Lec 19: Interest Rate Swaps | Part 9: Treasury-swap spread

上傳者:ColumbiaLearn

7:21

MOOC | Lec 20: Credit Default Swaps | Part 1: FT: Internationalization of the Euro

上傳者:ColumbiaLearn

5:07

MOOC | Lec 20: Credit Default Swaps | Part 2: Credit indices

上傳者:ColumbiaLearn

3:40

MOOC | Lec 20: Credit Default Swaps | Part 3: Fischer Black (1970), risk-free security

上傳者:ColumbiaLearn

2:14

MOOC | Lec 20: Credit Default Swaps | Part 4: What is a Credit Default Swap (CDS)

上傳者:ColumbiaLearn

5:12

MOOC | Lec 20: Credit Default Swaps | Part 5: Corporate bonds

上傳者:ColumbiaLearn

3:43

MOOC | Lec 20: Credit Default Swaps | Part 6: CDS pricing

上傳者:ColumbiaLearn

11:24

MOOC | Lec 20: Credit Default Swaps | Part 7: Market making in CDS

上傳者:ColumbiaLearn

4:03

MOOC | Lec 20: Credit Default Swaps | Part 8: Example: Negative basis trade and Liquidity Risk

上傳者:ColumbiaLearn

10:20

MOOC | Lec 20: Credit Default Swaps | Part 9: Example: Private backstop of marketmaking in CDS

上傳者:ColumbiaLearn

15:15

MOOC | Lec 20: Credit Default Swaps | Part 10: Example: Synthetic CDO as Collateral Prepayment

上傳者:ColumbiaLearn

6:44

MOOC | Lec 21: Central Banking for Shadow Banking | Part 1: FT: Regulation of shadow banking

上傳者:ColumbiaLearn

3:34

MOOC | Lec 21: Central Banking for Shadow Banking | Part 2: Shadow banking vs traditional banking

上傳者:ColumbiaLearn

6:55

MOOC | Lec 21: Central Banking for Shadow Banking | Part 3: Liquidity and solvency backstops

上傳者:ColumbiaLearn

7:18

MOOC | Lec 21: Central Banking for Shadow Banking | Part 4: Global dimension

上傳者:ColumbiaLearn

5:16

MOOC | Lec 21: Central Banking for Shadow Banking | Part 5: Evolution of modern finance

上傳者:ColumbiaLearn

3:19

MOOC | Lec 21: Central Banking for Shadow Banking | Part 6: What is shadow banking?

上傳者:ColumbiaLearn

12:22

MOOC | Lec 21: Central Banking for Shadow Banking | Part 7: Backstopping the market makers

上傳者:ColumbiaLearn

7:46

MOOC | Lec 21: Central Banking for Shadow Banking | Part 8: Regulation of systemic risk

上傳者:ColumbiaLearn

6:27

MOOC | Lec 21: Central Banking for Shadow Banking | Part 9: Regulation of Collateral and Payment

上傳者:ColumbiaLearn

10:30

MOOC | Lec 21: Central Banking for Shadow Banking | Part 10: Private backstop, and public

上傳者:ColumbiaLearn

8:20

MOOC | Lec 22: Touching the Elephant: Three Views | Part 1: FT: Future of banking

上傳者:ColumbiaLearn

4:46

MOOC | Lec 22: Touching the Elephant: Three Views | Part 2: Three world views

上傳者:ColumbiaLearn

15:14

MOOC | Lec 22: Touching the Elephant: Three Views | Part 3: Economics View: Commodity Exchange

上傳者:ColumbiaLearn

8:54

MOOC | Lec 22: Touching the Elephant: Three Views | Part 4: Finance View: Risk

上傳者:ColumbiaLearn

15:41

MOOC | Lec 22: Touching the Elephant: Three Views | Part 5: The education of Fischer Black

上傳者:ColumbiaLearn

4:52

MOOC | Lec 22: Touching the Elephant: Three Views | Part 6: Steps from finance view to money view

上傳者:ColumbiaLearn

7:45

MOOC | Lec 22: Touching the Elephant: Three Views | Part 7: A money view of economics and finance

上傳者:ColumbiaLearn

5:12

Perry 2 Lect 19.4_1_1

上傳者:ColumbiaLearn

8:55

Perry 2 Lect 19.3_2

上傳者:ColumbiaLearn

11:04

Perry 2 Lect 19.3_1_1

上傳者:ColumbiaLearn

11:04

Perry 2 Lect 19.2_2

上傳者:ColumbiaLearn

7:40

Perry 2 Lect 19.2_1_1

上傳者:ColumbiaLearn

7:40

Perry 2 Lect 19.1_2

上傳者:ColumbiaLearn

3:21

Perry 2 Lect 19.1_1_1

上傳者:ColumbiaLearn

3:21

Perry 2 Lect 18.9_2

上傳者:ColumbiaLearn

3:22

Perry 2 Lect 18.9_1_1

上傳者:ColumbiaLearn

3:22

Perry 2 Lect 18.8_2

上傳者:ColumbiaLearn

2:49

Perry 2 Lect 18.7_2

上傳者:ColumbiaLearn

5:26

Perry 2 Lect 18.6_2

上傳者:ColumbiaLearn

7:28

Perry 2 Lect 18.6_1_1

上傳者:ColumbiaLearn

7:28

Perry 2 Lect 18.5_2

上傳者:ColumbiaLearn

6:07

Perry 2 Lect 18.5_1_1

上傳者:ColumbiaLearn

6:07

Perry 2 Lect 18.4_2

上傳者:ColumbiaLearn

14:07

Perry 2 Lect 18.4_1_1

上傳者:ColumbiaLearn

14:07

Perry 2 Lect 18.3_2

上傳者:ColumbiaLearn

13:41

Perry 2 Lect 18.3_1_1

上傳者:ColumbiaLearn

13:41

Perry 2 Lect 18.2_2

上傳者:ColumbiaLearn

5:55

Perry 2 Lect 18.2_1_1

上傳者:ColumbiaLearn

5:55

Perry 2 Lect 18.1_2

上傳者:ColumbiaLearn

4:56

Perry 2 Lect 18.1_1_1

上傳者:ColumbiaLearn

4:56

Perry 2 Lect 17.10_2

上傳者:ColumbiaLearn

8:28

Perry 2 Lect 17.10_1_1

上傳者:ColumbiaLearn

8:28

Perry 2 Lect 17.9_2

上傳者:ColumbiaLearn

11:12

Perry 2 Lect 17.9_1_1

上傳者:ColumbiaLearn

11:12

Perry 2 Lect 17.8_2

上傳者:ColumbiaLearn

13:12

Perry 2 Lect 17.8_1_1

上傳者:ColumbiaLearn

13:12

Perry 2 Lect 17.7_2

上傳者:ColumbiaLearn

2:04

Perry 2 Lect 17.7_1_1

上傳者:ColumbiaLearn

2:04

Perry 2 Lect 17.6_2

上傳者:ColumbiaLearn

5:31

Perry 2 Lect 17.6_1_1

上傳者:ColumbiaLearn

5:31

Perry 2 Lect 17.5_2

上傳者:ColumbiaLearn

4:05

Perry 2 Lect 17.5_1_1

上傳者:ColumbiaLearn

4:05

Perry 2 lect 17.4_2

上傳者:ColumbiaLearn

2:33

Perry 2 lect 17.4_1_1

上傳者:ColumbiaLearn

2:33

Perry 2 Lect 17.3_2

上傳者:ColumbiaLearn

10:55

Perry 2 Lect 17.3_1_1

上傳者:ColumbiaLearn

10:55

Perry 2 lect 17.2_2

上傳者:ColumbiaLearn

8:51

Perry 2 lect 17.2_1_1

上傳者:ColumbiaLearn

8:51

Perry 2 Lect 17.1_2

上傳者:ColumbiaLearn

4:15

Perry 2 Lect 17.1_1_1

上傳者:ColumbiaLearn

4:15

Perry 2 Lect 16.9_2

上傳者:ColumbiaLearn

10:29

Perry 2 Lect 16.9_1_1

上傳者:ColumbiaLearn

10:29

Perry 2 Lect 16.8_2

上傳者:ColumbiaLearn

16:09

Perry 2 Lect 16.8_1_1

上傳者:ColumbiaLearn

16:09

Perry 2 Lect 16.7_2

上傳者:ColumbiaLearn

9:45

Perry 2 Lect 16.7_1_1

上傳者:ColumbiaLearn

9:45

Perry 2 Lect 16.6_2

上傳者:ColumbiaLearn

6:15

Perry 2 Lect 16.6_1_1

上傳者:ColumbiaLearn

6:15

Perry 2 Lect 16.5_2

上傳者:ColumbiaLearn

5:57

Perry 2 Lect 16.5_1_1

上傳者:ColumbiaLearn

5:58

Perry 2 Lect 16.4_2

上傳者:ColumbiaLearn

10:41

Perry 2 Lect 16.4_1_1

上傳者:ColumbiaLearn

10:41

Perry 2 Lect 16.3_2

上傳者:ColumbiaLearn

5:03

Perry 2 Lect 16.3_1_1

上傳者:ColumbiaLearn

5:03

Perry 2 Lect 16.2_2

上傳者:ColumbiaLearn

2:22

Perry 2 Lect 16.2_1_1

上傳者:ColumbiaLearn

2:22

Perry 2 Lect 16.1_2

上傳者:ColumbiaLearn

4:41

Perry 2 Lect 16.1_1_1

上傳者:ColumbiaLearn

4:41

Perry 2 Lect 15.6_2

上傳者:ColumbiaLearn

9:37

Perry 2 Lect 15.6_1_1

上傳者:ColumbiaLearn

9:37

Perry 2 Lect 15.5_2

上傳者:ColumbiaLearn

12:08

Perry 2 Lect 15.5_1_1

上傳者:ColumbiaLearn

12:08

Perry 2 Lect 15.4_2

上傳者:ColumbiaLearn

8:43

Perry 2 Lect 15.4_1_1

上傳者:ColumbiaLearn

8:43

Perry 2 lect 15.3_2

上傳者:ColumbiaLearn

10:05

Perry 2 lect 15.3_1_1

上傳者:ColumbiaLearn

10:05

Perry 2 Lect 15.2_2

上傳者:ColumbiaLearn

11:42

Perry 2 Lect 15.2_1_1

上傳者:ColumbiaLearn

11:42

Perry 2 Lect 15.1_2

上傳者:ColumbiaLearn

2:37

Perry 2 Lect 15.1_1_1

上傳者:ColumbiaLearn

2:37

Perry 2 Lect 14.7_2

上傳者:ColumbiaLearn

17:58

Perry 2 Lect 14.7_1_1

上傳者:ColumbiaLearn

17:58

Perry 2 Lect 14.6_2

上傳者:ColumbiaLearn

8:28

Perry 2 Lect 14.6_1_1

上傳者:ColumbiaLearn

8:28

Perry 2 Lect 14.5_2

上傳者:ColumbiaLearn

7:04

Perry 2 Lect 14.5_1_1

上傳者:ColumbiaLearn

7:04

Perry 2 Lect 14.4_2

上傳者:ColumbiaLearn

14:08

Perry 2 Lect 14.4_1_1

上傳者:ColumbiaLearn

14:08

Perry 2 Lect 14.3_2

上傳者:ColumbiaLearn

11:48

Perry 2 Lect 14.3_1_1

上傳者:ColumbiaLearn

11:48

Perry 2 Lect 14.2_2

上傳者:ColumbiaLearn

10:27

Perry 2 Lect 14.2_1_1

上傳者:ColumbiaLearn

10:27

Perry 2 Lect 14.1_2

上傳者:ColumbiaLearn

2:49

Perry 2 Lect 14.1_1_1

上傳者:ColumbiaLearn

2:49

Perry 2 Lect 13.11_2

上傳者:ColumbiaLearn

5:33

Perry 2 Lect 13.11_1_1

上傳者:ColumbiaLearn

5:33

Perry 2 Lect 13.10.1_2

上傳者:ColumbiaLearn

7:30

Perry 2 Lect 13.10.1_1_1

上傳者:ColumbiaLearn

7:30

Perry 2 Lect 13.9.1_2

上傳者:ColumbiaLearn

4:29

Perry 2 Lect 13.9.1_1_1

上傳者:ColumbiaLearn

4:29

Perry 2 Lect 13.8.1_2

上傳者:ColumbiaLearn

11:36

Perry 2 Lect 13.8.1_1_1

上傳者:ColumbiaLearn

11:36

Perry 2 Lect 13.7.1_2

上傳者:ColumbiaLearn

5:07

Perry 2 Lect 13.7.1_1_1

上傳者:ColumbiaLearn

5:07

Perry 2 Lect 13.6.1_2

上傳者:ColumbiaLearn

3:02

Perry 2 Lect 13.6.1_1_1

上傳者:ColumbiaLearn

3:02

Perry 2 Lect 13.5_2

上傳者:ColumbiaLearn

4:39

Perry 2 Lect 13.5_1_1

上傳者:ColumbiaLearn

4:39

Perry 2 Lect 13.4_2

上傳者:ColumbiaLearn

2:11

Perry 2 Lect 13.4_1_1

上傳者:ColumbiaLearn

2:10

Perry 2 lect 13.3_2

上傳者:ColumbiaLearn

8:37

Perry 2 lect 13.3_1_1

上傳者:ColumbiaLearn

8:37

Perry 2 Lect 13.2_2

上傳者:ColumbiaLearn

8:38

Perry 2 Lect 13.2_1_1

上傳者:ColumbiaLearn

8:38

Perry 2 Lect 13.1_2

上傳者:ColumbiaLearn

2:14

Perry 2 Lect 13.1_1_1

上傳者:ColumbiaLearn

2:14

Perry 1 lect rev.10_4

上傳者:ColumbiaLearn

10:29

Perry 1 lect rev.10_3_1

上傳者:ColumbiaLearn

10:29

Perry 1 lect rev.9_4

上傳者:ColumbiaLearn

12:21

Perry 1 lect rev.9_3_1

上傳者:ColumbiaLearn

12:21

Perry 1 lect rev.8_4

上傳者:ColumbiaLearn

7:21

Perry 1 lect rev.8_3_1

上傳者:ColumbiaLearn

7:21

Perry 1 lect rev.7_4

上傳者:ColumbiaLearn

4:29

Perry 1 lect rev.7_3_1

上傳者:ColumbiaLearn

4:29

Perry 1 lect rev.6_4

上傳者:ColumbiaLearn

2:31

[已刪除的影片]

Perry 1 lect rev.5_4

上傳者:ColumbiaLearn

4:31

Perry 1 lect rev.5_3_1

上傳者:ColumbiaLearn

4:31

Perry 1 lect rev.4_4

上傳者:ColumbiaLearn

4:45

Perry 1 lect rev.4_3_1

上傳者:ColumbiaLearn

4:45

Perry 1 lect rev.3_4

上傳者:ColumbiaLearn

7:52

Perry 1 lect rev.3_3_1

上傳者:ColumbiaLearn

7:52

Perry 1 lect rev.2_5

上傳者:ColumbiaLearn

3:52

Perry 1 lect rev.2_1_1

上傳者:ColumbiaLearn

3:52

Perry 1 lect rev.1_4

上傳者:ColumbiaLearn

5:31

Perry 1 lect rev.1_1_1

上傳者:ColumbiaLearn

5:31

No comments:

Post a Comment